Fixed assets

Assets are the objects managed by the Fixed assets subsystem. An Asset is generally anything of value for which you want to store its details, cost and depreciation information. An Asset can support separate book and tax depreciation schedules as well as purchasing and disposal information.

The following rules apply to Assets:

- An Asset must have a depreciation rate and a depreciation type of Prime cost, Diminishing value or Full

- An Asset does not have to be depreciated: its depreciation rate can be set to zero

- An Asset cannot be depreciated further if the Written down value is zero

- An Asset can only be deleted if it has been fully depreciated or disposed, and no transactions exist for that Asset within the current financial year

- Asset codes are FlexiCode

- Transactions supported include Depreciation, Revaluation, Disposal and Addition

- Assets can be assigned a private usage percentage for tax purposes

- Warranty information and expiry date can be stored per Asset

- A photograph of each Asset can be stored and displayed

- A complete list of all Asset transactions is maintained

- General ledger accounts for depreciation can be different for each Asset

- Automatic transfer of current written down value to new account if Asset account changes

- Manual or automatic Asset code selection for new Assets

- Supports Pending delete status

- Assets can be automatically fully depreciated up to a Disposal, Addition or Revaluation transaction

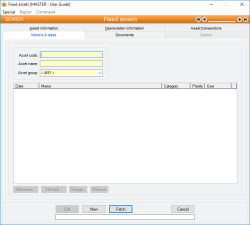

Module: Fixed assets

Category: Assets

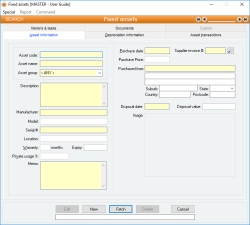

Activation: Main > Fixed assets > Assets

Form style: Multiple instance, WYSIWYS, SODA

Special actions available for users with Administrator permissions:

- View and edit deleted assets with the Allow display of deleted records menu option.

- Change the User ID of the Entered by field of memos.

- Edit memos entered by other users.

Database rules:

- An Asset cannot be deleted if it has any transactions in the current financial year or if its current written down value is not zero

Reference: text(15), mandatory, WYSIWYS

This is the code that is used to identify the Asset. The code used here should be long enough to make it unique across all Assets, but short enough to make it convenient to use as an identifier.

The Asset code is a FlexiCode. This allows you to modify the Asset code while still retaining all previous internal references and links to that Asset.

In Add or Edit mode you can leave the Asset code empty and it will display the text *Auto assign*. This means that when you update the record, the next available unique Asset number will be assigned as the Asset code.

Reference: Select form list, mandatory, HotEdit, WYSIWYS

This is the group to which this asset belongs. When you select an asset group for an asset, details for the current asset will be updated with those specified for the selected asset group.

Reference: memo, expandable, WYSIWYS

This is a full description of the Asset containing as much information as you need to describe the Asset. This would usually include characteristics such as colour, size, shape or any other specific details pertinent to the Asset.

The Asset form has specific fields for Manufacturer, Model and Serial # so these need not be entered into this field.

This is the serial number of your Asset, if applicable. The serial number is a very important method of identifying a specific Asset where there may be multiple Assets of the same type. It may also be necessary for insurance purposes to be able to provide a serial number for the Asset in case of theft.

Reference: text(20)

This is the physical location of the Asset. It can be as detailed as you like to be able to determine where to find the Asset.

Reference: number

This is the number of months of warranty provided on your Asset, if applicable, from the Purchase date. If this field is filled in, the Warranty expiry date will show the date on which the warranty expires based on your Purchase date and the Warranty months.

Reference: quantity

This is a percentage of private usage of the Asset. This is used in reports and searches to be able to determine the claimable amount of tax depreciation.

Reference: memo, expandable, WYSIWYS

This is free form text that is used to enter any general information about the Asset that you want to keep as a reference.

Reference: date, mandatory, QuickList, WYSIWYS

This is the date the Asset was purchased and can be any valid date. This does not have to be the same date as the Depreciation start date on the Depreciation information tab.

The warranty expiry date is calculated using this date in combination with the value entered in the Warranty field.

Reference: date, read-only, WYSIWYS

This is the date on which the Asset was disposed. This is a read-only field since an Asset can only be disposed by performing a Disposal asset transaction, which in turn prompts for a date. The amount for which the Asset was disposed is shown in the Disposal value field.

Reference: Image

This displays a graphical image representing the record, which can then be used on the screen as a visual aid, or in reports which can then be printed, faxed or emailed to customers.

To add an image to a record

Right-click with your mouse in the image box, click on Select image from the popup menu and then select the image file required. Both JPG and BMP file types are supported.

If an image is not selected

If there is a .jpg or .bmp document attached to the record with the word photo in the file name, it will automatically be displayed as the image for that record.

If a record is part of a Product group, the image assigned to that product group will display by default.

Image sizing

Once an image has been added to a record, it is displayed fitted to the size of the image area. If the ratio of the image is not the same as the ratio of the image area, the image will be stretched to fit the image area.

If the full image is not required on the form, you can select the required section of the image by double clicking on it. This will display a full sized version of the image upon which you can highlight, via clicking and dragging the mouse, the area you wish to see by default on the form. The selection area will automatically snap to the same ratio as the display area on the form, so that when the selection is displayed, it will not be distorted due to stretching.

To reposition the highlighted area in the horizontal plane during selection, hold the control key down while moving the mouse.

The size of the image selected will impact on the speed at which you can cycle through records displayed on the form, particularly if the images are accessed over a network or the internet. It is recommended that only JPEG (compressed) images are used.

Last edit 06/09/23

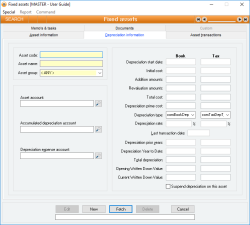

Reference: account, mandatory, QuickList

This is the General ledger account used to store the book prime cost of the Asset. The prime cost of the Asset is the original cost that was used as the starting point for the value of the Asset before any depreciation has occurred.

When you add an Asset, you are expected to have added the book prime cost of that Asset to the specified Asset account (usually though a Receive or a Payment).

The Asset account is updated by the Fixed assets subsystem whenever a Revaluation or Disposal is performed for the Asset.

The current written down value of all of your Assets should always equal the sum of all of their Asset account balances less the sum of all of their Accumulated depreciation account balances.

Reference: account, mandatory, QuickList

This is the General ledger account used to tally up the reduction in value of the Asset due to accumulated depreciation. The amount of any depreciation transaction for the Asset is credited to this account.

The current written down value of all of your Assets should always equal the sum of all of their Asset account balances less the sum of all of their Accumulated depreciation account balances.

Reference: account, mandatory, QuickList

This is the General ledger account that is updated every time the Asset is depreciated. The amount of any depreciation transaction for the Asset is debited to this account.

The current written down value of all of your Assets should always equal the sum of all of their Asset account balances less the sum of all of their Accumulated depreciation account balances.

Reference: date, mandatory, QuickList

This is the date on which depreciation calculations should begin for both Book and Tax depreciation schedules. The very first depreciation transaction for an Asset is calculated from the Depreciation start date up to and including the date of the depreciation transaction.

The date entered here can be any valid date and does not have to be within the current financial year. The Depreciation start date can be different for Book and Tax depreciation schedules.

If an Asset has undergone any transactions, its Depreciation start date cannot be changed.

Reference: currency, mandatory

This is the very first cost associated with the asset before any revaluation or additions have been performed. This value is the same as the Depreciation prime cost before additions or revaluations.

If an asset has undergone any transactions, its Initial cost cannot be changed.

Reference: currency, read-only

This value shows the total value of all addition transactions that have been performed upon this asset. The value of any addition transaction is added to the asset's initial cost (along with any revaluation amounts) to arrive at the asset's Depreciation prime cost value which is then used as a basis on which to calculate any prime cost depreciation amounts.

This amount is recalculated after each asset transaction and cannot be changed by the user.

Reference: currency, read-only

This value shows the total value of all revaluation transactions that have been performed upon this asset. The value of any revaluation transaction is added to the asset's initial cost (along with any addition amounts) to arrive at the asset's Depreciation prime cost value which is then used as a basis on which to calculate any prime cost depreciation amounts.

This amount is recalculated after each asset transaction and cannot be changed by the user.

Reference: currency, mandatory

This is the (adjusted) cost of the Asset for both Book and Tax depreciation schedules. It represents the value of the Asset that is used for prime cost depreciation transactions. When an asset is first added to the system, the value entered here should be the same value that was added to the asset's Asset account when the asset was purchased or entered into the system.

The Depreciation prime cost of an asset is equivalent to the asset's Initial cost plus any additions and revaluations.

The current written down value of an asset is equal to its Depreciation prime cost less any accumulated depreciation.

This field is always a calculated field and cannot be modified by the user.

Reference: select from list, mandatory

This is the type of depreciation calculation that will be used whenever the Asset is depreciated. It must be one of the following:

- Prime cost: Each time the Asset is depreciated, it is depreciated by a percentage (the Depreciation rate) of the Depreciation prime cost value

- Diminishing value: Each time the Asset is depreciated, it is depreciated by a percentage (the Depreciation rate) of the current written down value of the Asset

- Full: The first time the Asset is depreciated, it is depreciated for the full amount of its Depreciation prime cost leaving it with a written down value of zero

If an Asset has undergone any transactions, its Depreciation type cannot be changed.

Reference: quantity, mandatory

This is the rate of depreciation for a full year for a depreciation type of Prime cost or Diminishing value expressed as a percentage. If a depreciation transaction is being performed for only a portion of a year, only the proportionate amount of the depreciation rate is used to calculate the depreciation value.

You are able to change the depreciation rate even if Asset transactions have already been performed for the Asset.

Reference: date, QuickList, read-only

This is the date of the last transaction that was performed for the Asset, and represents the date from which the next depreciation transaction will be calculated. If the Asset has never undergone any transactions, this date will not be shown and any transactions that use the Last transaction date will use the day immediately prior to the Depreciation start date as the effective Last transaction date.

The last transaction date is read-only and can only change by performing an Asset transaction.

Reference: currency

This is the value of accumulated depreciation that has occurred in years prior to the current financial year for this Asset.

If the Asset was a part of Accentis Enterprise in the previous year and had undergone asset transactions, this field will be set to the accumulated depreciation for the prior year and will not be able to be changed.

If the Asset is being added from an existing system, the Depreciation prior years should be filled with the value of the accumulated depreciation up to beginning of the current financial year. The value entered into this field is not automatically added to the Accumulated depreciation account.

If an Asset has undergone any transactions, its Depreciation prior years cannot be changed.

Reference: currency

This value represents the accumulated depreciation that has been calculated for the Asset for the current financial year.

This amount can only be updated by performing depreciation transactions for the Asset or by entering a value before any transactions occur for the Asset.

If an Asset is being added from an existing system, this should represent the accumulated depreciation for the Asset from the start of the financial year up to (but not including) the Depreciation start date.

Reference: currency, read-only

This is the total depreciation for the Asset, which is a combination of the depreciation in prior years plus the depreciation for the current financial year to date.

The current written down value of an Asset is its Depreciation start cost less the Total depreciation plus any addition or revaluation amounts.

Reference: currency, read-only

This is the current written down value of the Asset. It is what the Asset is currently worth based on the parameters of the Book or Tax depreciation schedule.

The current written down value of an Asset is its Depreciation start cost less the Total depreciation plus any addition or revaluation amounts.

Reference: yes/No

This option allows you to specify that the Asset is not to be depreciated until further notice. You will not be able to perform depreciation transactions on this Asset while the option is set.

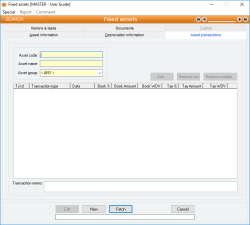

Reference: button

This button displays the Asset transaction form in which you can perform a single asset transaction for the Asset. This button is not available in Add or Edit mode and it is also not available once an Asset has been disposed of. See Asset Transaction.

Reference: button

This button removes the very last transaction that has been performed for an Asset, if such a transaction exists. It is the only way you can delete any transaction for an Asset and the transactions can only be removed in the reverse order to which they were created.

When you click on this button, you will be prompted to confirm that you really want to remove the last transaction. If you click on Yes you cannot undo the operation, however you can always re-do the transaction.

After a transaction has been deleted, the written down value of the Asset is exactly as it was before the transaction was added. This means that if you add and then remove the same transaction, there is no change in the Asset or its value.

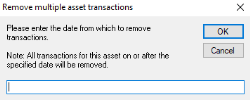

Reference: button

This button allows for multiple depreciation transactions to be removed at once. When you click on the Remove multiple button, you will be asked to enter the date from which you would like to remove the transactions.

When you click ok you will be asked – Are you sure you want to remove all transactions for this asset from xx/xx/xx onwards? If you click yes, all transactions from the date onwards will be removed. You cannot undo the operation, however you can always redo the transactions.

After the transactions have been deleted, the written down value of the Asset is exactly as it was before the transactions were added. This means that if you add and then remove the same transactions, there is no change in the Asset or its value.

This list shows all of the transactions that have ever happened for an Asset, not just in the current financial year. The columns shown are as follows:

- Tx ID: The unique transaction Id that has been automatically assigned to the Asset transaction. The Transaction Id is unique across all Assets in the system and is used as the primary reference (Ref #1) in the Journal transactions list

- Transaction type: The type of transaction that was performed, which will be either Depreciation, Addition, Revaluation or Disposal. See Asset transactions for more details

- Date: The date on which the transaction was performed

- Book %: The depreciation rate for the Book depreciation schedule if the transaction type was Depreciation

- Book amount: The book amount of the transaction. For a Disposal, this represents the disposal amount, for a Revaluation this represents the amount by which the Asset was revalued, for an Addition this represents the amount of the addition and for a Depreciation this represents the amount of depreciation

- Book WDV: The book written down value after the transaction has been processed

- Tax %: As for Book % except that it refers to the Tax depreciation schedule

- Tax Amount: As for Book amount except that it refers to the Tax depreciation schedule

- Tax WDV: As for Book WDV except that it refers to the Tax depreciation schedule

This is a list of all memos that have been made about this asset. A memo can be added / edited at any time. The list of memos for an asset produces a history of how the asset has been modified, used or managed.

- To add a new memo, click on the New memo button to display a form that will allow you to enter the date > the user > the memo text.

- To edit an existing memo, either click on the Edit memo button or double-click on the list entry.

- To delete a memo, click on the Delete memo button.

Memos cannot be edited unless the Asset form is in Edit mode.

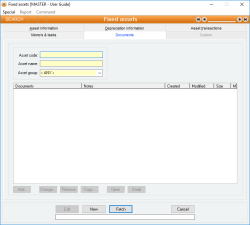

This is a list of all relevant data files associated with the asset. They can be data specification documents, marketing material, purchasing documents or any other document that is appropriate.

The document list is a list of files names and associated files. You can specify any type of file that you like, even image or multimedia files.

In Idle mode, if you double-click on one of the list items, the associated document will be opened by Windows providing an appropriate file association exists.

You can Add, Edit or Delete the list of data files by using the buttons at the bottom of the list. There is no practical limit to the number of data files you can specify for an asset.

If you do not specify a full pathname for the filename of a data file, the default data file directory found in the Database Setup will be used.

It is possible to drag /drop multiple documents from a list as well as use the Remove, Copy and Email buttons. When multiple documents are selected, the Change and Open buttons are disabled as these options are only related to individual documents

Last edit: 28/05/20

Reference: Menu

If set, this will display records that have been set as “Pending delete”. This means that a user has deleted them, but because they are linked to other data and historical records, they are not able to be properly deleted and are put into a “recycle bin”. Under normal circumstances you won’t see these records but the option to “Allow display of deleted records” will make them appear while this window is open. If you close the window, and reopen it, you will need to select the “Allow display of deleted records” option if you wish to see the pending-deleted records again.

Note: Once a record has been permanently deleted (that is, there are no linked records and the data has actually been removed), this option will not show those records.

See Pending delete for more information.